Click the arrow above to play the video

Most of my topics on the TV morning shows are about enjoying wine with family and friends.

However, recently I’ve started speaking out on the 6 pm newscasts, like this one from CTV, about the taxes levied on the Canadian wine industry. They’re higher than any other wine-producing country.

This issue deserves your attention given its impact on the future of our wineries. I encourage you to contact your Member of Parliament (email addresses are noted with each member’s name).

CTV News at 6 pm:

The latest excise tax increase on alcohol, fossil fuels and tobacco went into effect recently. Here to talk about the impact of this tax on Canadian wineries is Natalie MacLean, editor of Canada’s largest independent wine site at nataliemaclean.com.

Give us your high level take on the impact the latest increase will have on domestic wineries.

The latest excise tax, along with soaring inflation, is really squeezing Canadian wineries, most of which are small, family-run farms with fewer than 20 employees. It also gives an unfair advantage to foreign wines coming into our market.

They’re subsidized by their own governments in ways that Canadian wineries are not, with billions in funding every year for everything from production to marketing.

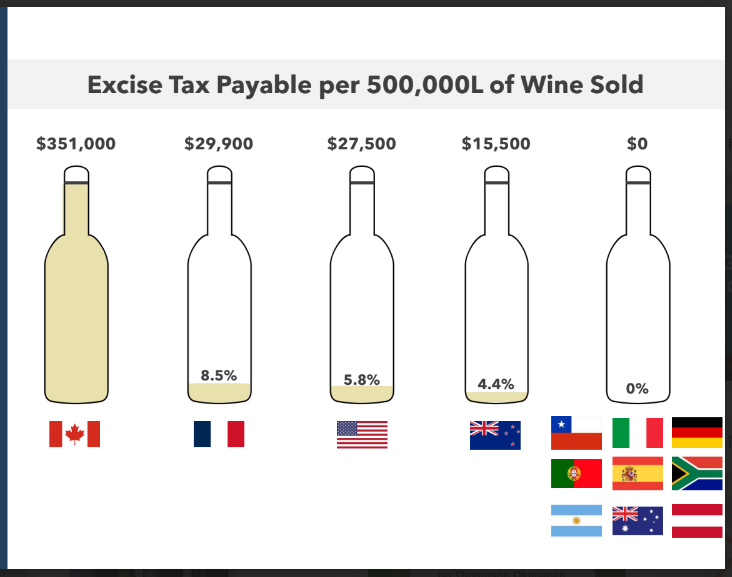

For example, a medium-sized Canadian winery pays $358,000 in excise tax. Just across the border, in New York state, a winery of the same size pays only $27,000 in excise tax. In France, it’s $9,000. In Italy and Spain, it’s zero.

Credit: John Peller, CEO, Andrew Peller Inc.

Slide from keynote presentation at the B.C. Wine Insights Conference 2024

That’s cash flow that could have been reinvested in a very capital-intensive business, with the high costs of equipment and land as well as long time horizons before there’s a return on investment.

It takes vines seven years before they come into full maturity to produce the grapes that make top-notch wines. This reinvestment would represent a much larger return for our national and regional economies than this upfront tax.

Lumping Canadian wineries in with polluting automobiles and cigarettes under this “sin tax” is unfair, especially when wine is the highest value-added agricultural product we produce in this country.

It adds 45,000 jobs, mostly in rural areas, and $11.6 billion to our economy every year. And yet, 73% of the price of wine goes to the government-owned liquor stores, provincial and federal governments.

Credit: Potter Settlement Artisan Wines

Doesn’t the price cap on the excise tax help?

When you’re already paying the highest taxes in the world any reduction of the tax burden helps, but it’s still too steep. Canadian wineries operate on razor-thin margins. Most don’t produce enough wine to get into the government-owned liquor stores across the country.

The government taxes Canadian wineries as though they’re foreign imports. No other wine-producing region does this to its own wines.

Do you think this increased tax will put some wineries out of business?

Dozens of Canadian wineries have gone bankrupt, are up for sale or were purchased by foreign investors due to the triple hit of the pandemic when they had to close their doors to winery visitors and couldn’t sell to restaurants, 40-year-high inflation rates and now increased taxes.

More than 70% of wine sold in Canada is imported wine from much larger producing countries such as France, Italy, Spain, the US, and Australia. In fact, there are eight wineries in California that individually produce more wine than all of Canada.

They dominate our market and receive generous government funding support along with much lower tax levels — so much so that prices for their value brands in liquor stores are below the cost of production in Canada.

I should add that I drink wines from around the world, give them high ratings when deserved and believe that they have a solid place in the Canadian market.

After all, the beauty of wine is in its diversity. I’m just advocating for a level playing field for Canadian producers to compete.

How do you think the government should tax wineries?

Indexing tax increases with inflation is punitive, especially when post-Pandemic inflation rates have hit 40-year highs. Tax increases should be debated and voted on by Parliament and consider both the extreme foreign competition and the fact that Canadian wineries represent a cornerstone of this country’s rural economy.

Also, wine is also an agricultural product, very susceptible to climate change as we’ve seen in BC where they’ve just lost 97% of their crop this year due to an early frost. Wine isn’t a widget that you can make in a factory. It’s a grassroots agricultural product.

But isn’t this the government’s way of decreasing alcohol consumption?

Raising taxes on wine doesn’t always mean that prices go up and consumption drops. Many Canadian wineries just take this tax hike as another hit to their bottom line and keep prices the same because if they increase their price, consumers will just switch to a lower-priced imported wine.

Meanwhile, imported wines, with much larger productions and economies of scale, can absorb the tax increase into their costs easily without raising prices.

As well, Health Canada’s guidelines remain the same since 2011, advising a maximum of 1-2 glasses of wine per day for women; 2-3 for men. In fact, Wine Growers Canada, representing 800 wineries across the country, launched a campaign last year to encourage moderation.

Wine is an important part of many diverse cultures and many people, including me, feel it’s a part of our social well-being over dinner with friends and family in moderation.

Any final thoughts?

Yes, support Canadian wineries by purchasing them in the liquor or directly from the winery online as most will ship to your door; we vote with our dollars.

I’ve been reviewing these wines for twenty years and they stand shoulder to shoulder with the best from around the world. They have the competition medals to prove it.

If there was ever a time to buy local, drink local, now is it so that we have these wines in the future and all the richness they bring to our table and our lives.

The three excellent wines on the set are:

Marynissen Pinot Noir

Niagara Peninsula, Ontario V.Q.A., Canada

Westcott Brilliant Sparkling Rosé

Vinemount Ridge, Niagara Peninsula, Ontario V.Q.A., Canada

Quails’ Gate Pinot Noir

Okanagan Valley, British Columbia V.Q.A., Canada

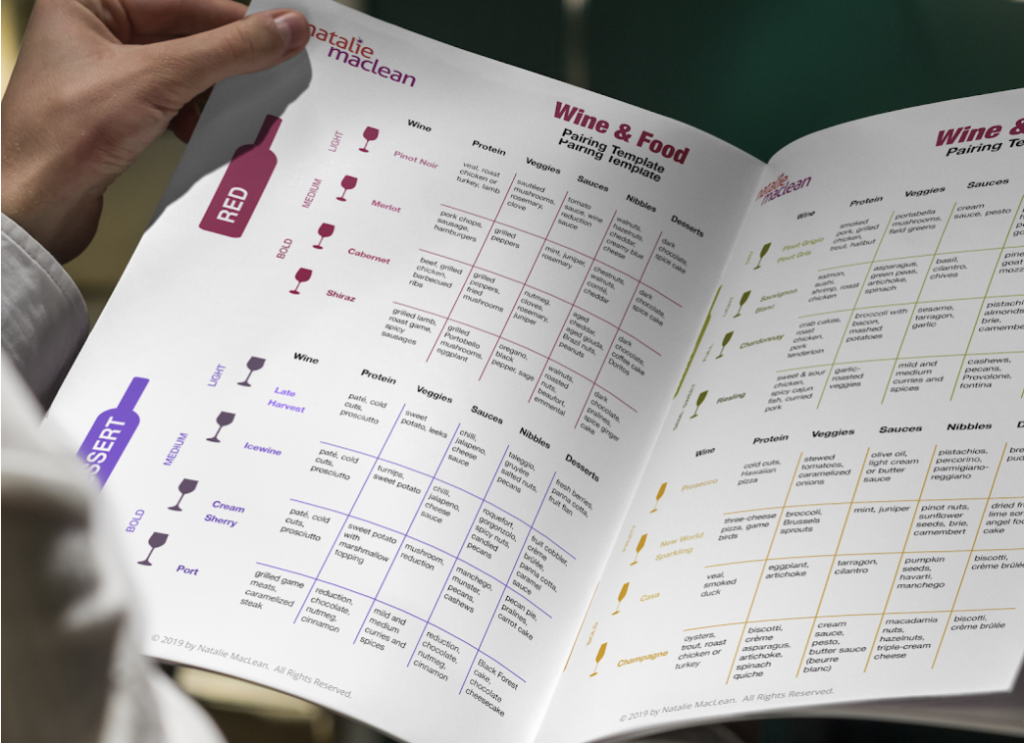

You can get my free Ultimate Food and Wine Pairing guide here: nataliemaclean.com/guide